5 Steps Homestead Exemption

Introduction to Homestead Exemption

The concept of homestead exemption is a significant aspect of property law, offering homeowners a degree of protection against creditors and reducing the amount of property taxes they owe. This exemption is particularly beneficial for individuals who are struggling financially or are looking to safeguard their primary residence from potential seizures. In this blog post, we will delve into the details of homestead exemption, its benefits, and the steps to apply for it.

Understanding Homestead Exemption

Homestead exemption is a legal provision that shields a certain value of a primary residence from creditors and, in some cases, reduces property taxes. The specifics of the exemption, including the amount protected and the types of creditors it applies to, vary from state to state. For instance, some states offer a flat exemption amount, while others provide a percentage-based exemption. Understanding these nuances is crucial for homeowners looking to leverage this exemption.

Benefits of Homestead Exemption

The benefits of homestead exemption are multifaceted: - Protection from Creditors: It provides a safety net against creditors, ensuring that a portion of the home’s value remains secure. - Reduced Property Taxes: In many jurisdictions, the exemption also results in lower property tax bills, as the taxable value of the property is reduced. - Incentivizes Homeownership: By offering these protections, homestead exemption policies encourage individuals to invest in their homes and communities.

5 Steps to Apply for Homestead Exemption

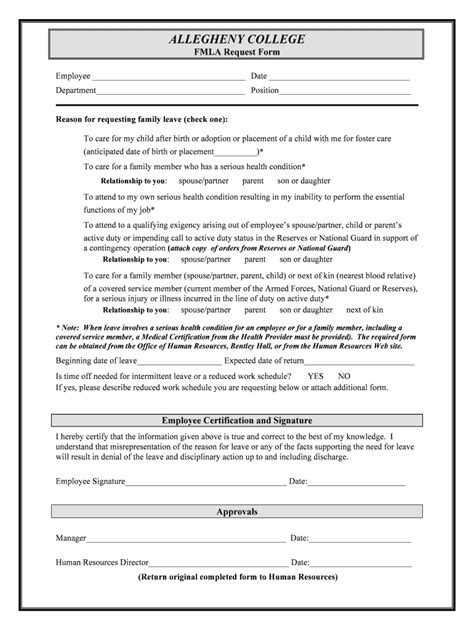

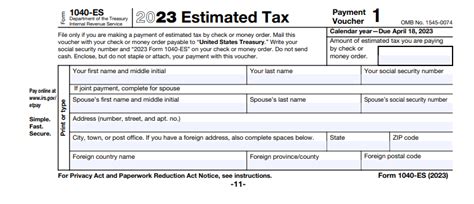

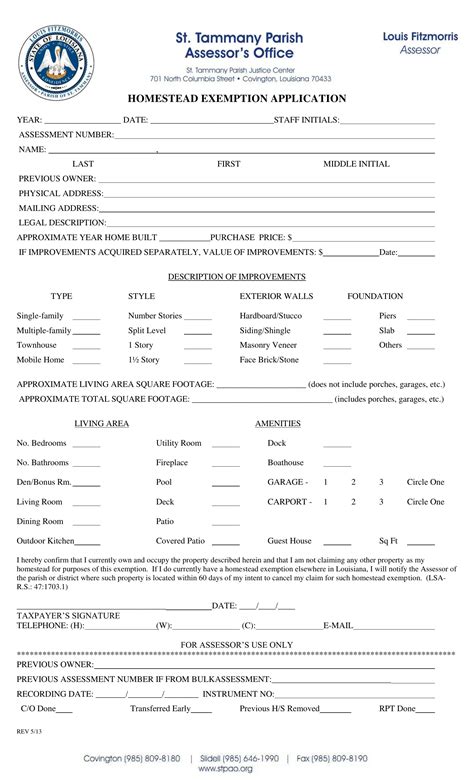

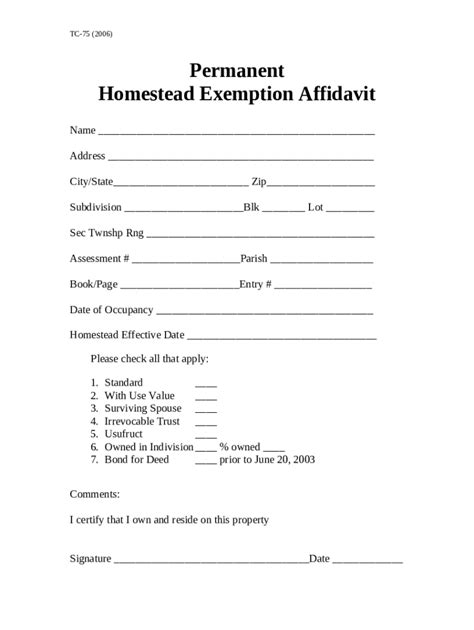

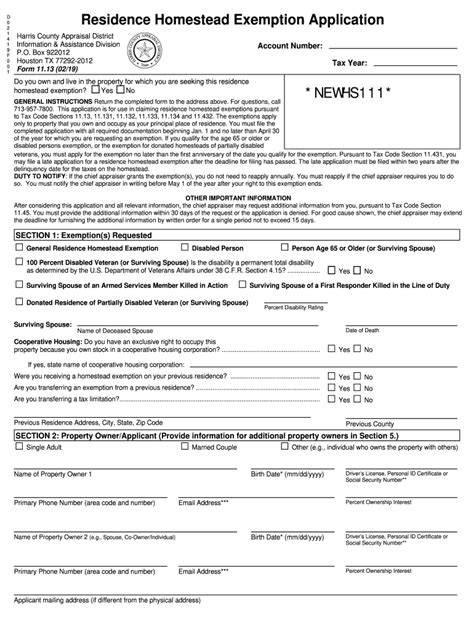

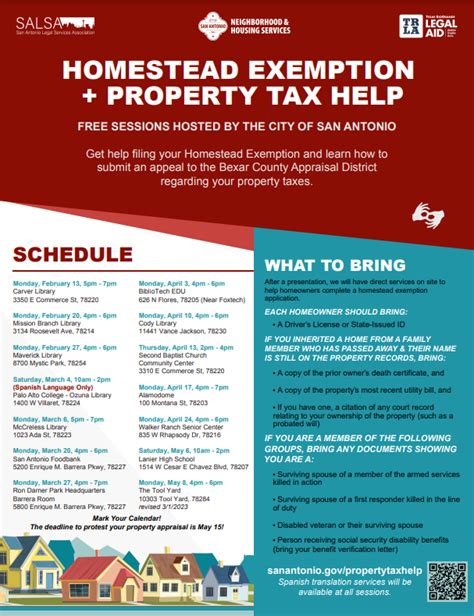

Applying for homestead exemption involves several key steps: 1. Determine Eligibility: The first step is to check if you are eligible for the homestead exemption in your state. This typically involves owning and occupying the property as your primary residence. Residency requirements and ownership structures can affect eligibility, so it’s essential to review the specific laws in your area. 2. Gather Required Documents: You will need to gather various documents, including: - Proof of ownership (deed or title) - Proof of residency (utility bills, driver’s license) - Identification (passport, ID card) - Possibly, income statements or other financial documents 3. Complete the Application Form: Obtain the application form from your local tax assessor’s office or download it from their official website. Fill it out accurately and completely, ensuring all required fields are filled in. It’s a good idea to review the form carefully before submission to avoid any errors. 4. Submit the Application: Once you have completed the form and gathered all necessary documents, submit your application to the tax assessor’s office. Be sure to meet the deadline for submission, as late applications may not be accepted or may result in delayed processing. 5. Follow Up: After submitting your application, follow up with the tax assessor’s office to confirm receipt and to inquire about the status of your application. This step is crucial to ensure that your application is processed in a timely manner and to address any potential issues promptly.

Important Considerations

When applying for homestead exemption, several factors are worth considering: - State and Local Variations: The rules and benefits of homestead exemption vary significantly by state and even by local jurisdiction. Researching the specific laws in your area is essential. - Annual Renewal: In some cases, the exemption must be renewed annually. Setting a reminder or automating the renewal process can help ensure continued eligibility. - Impact on Other Tax Benefits: Claiming homestead exemption might affect eligibility for other tax benefits or deductions. Consulting with a tax professional can provide clarity on these interactions.

📝 Note: The process and requirements for homestead exemption can change, so it's crucial to stay updated with the latest information from your local tax authority.

In summary, homestead exemption is a valuable legal provision that offers protection and financial benefits to homeowners. By understanding the eligibility criteria, application process, and specific rules in your jurisdiction, you can effectively leverage this exemption to safeguard your home and reduce your tax burden. Whether you’re a long-time homeowner or a new resident, taking the time to apply for homestead exemption can have significant long-term benefits.

What is the primary purpose of homestead exemption?

+

The primary purpose of homestead exemption is to protect a portion of the value of a primary residence from creditors and, in some cases, reduce property taxes.

How do I determine if I am eligible for homestead exemption?

+

To determine eligibility, you should review the specific laws in your state, focusing on residency requirements, ownership structures, and any other criteria that may apply.

What documents are typically required to apply for homestead exemption?

+

Required documents often include proof of ownership, proof of residency, identification, and possibly income statements or other financial documents, depending on the jurisdiction’s requirements.